In the ever-evolving world of digital finance, cryptocurrencies have emerged as one of the most exciting and potentially lucrative asset classes. With thousands of digital coins and tokens available, it can be overwhelming to determine which ones are truly worth your investment. This in-depth guide explores the best cryptocurrencies to invest in for 2025

Understanding Cryptocurrency Investments

Before diving into specific coins, it’s important to understand what makes a cryptocurrency a good investment. Unlike traditional assets, cryptocurrencies can be volatile, but they also offer the potential for high returns. Here are the main factors investors consider:

-

Utility and use cases: A coin with real-world applications is more likely to gain long-term value.

-

Market capitalization and liquidity: A higher market cap generally indicates stability, while liquidity ensures ease of buying and selling.

-

Development team and community support: Active communities and transparent development teams are strong indicators of a project’s potential.

-

Security and decentralization: Coins with robust blockchain technology are more secure against attacks.

-

Regulatory outlook: Projects that work within regulatory frameworks tend to be more sustainable in the long run.

With these criteria in mind, let’s explore the best cryptocurrencies to invest in this year.

Bitcoin (BTC): The King of Crypto

Bitcoin remains the gold standard in cryptocurrency investing. As the first and most well-known cryptocurrency, it continues to dominate the market.

Why Invest in Bitcoin?

-

Widespread adoption: Accepted by merchants, institutions, and even some governments.

-

Limited supply: Only 21 million BTC will ever exist, making it a deflationary asset.

-

Store of value: Often compared to digital gold, it’s seen as a hedge against inflation.

-

Strong network effect: Its security and size make it less prone to manipulation.

Despite its volatility, Bitcoin’s track record and position make it one of the best cryptocurrencies to invest in for long-term growth and stability.

Ethereum (ETH): The Smart Contract Pioneer

Ethereum introduced smart contracts, enabling decentralized applications (dApps) and launching the DeFi revolution.

Ethereum’s Strengths

-

Smart contract functionality: Powers thousands of applications, from finance to gaming.

-

Transition to Ethereum 2.0: Now using Proof of Stake (PoS), it is more energy-efficient and scalable.

-

Strong developer ecosystem: The largest community of blockchain developers.

-

Massive network: Supports NFTs, DeFi, DAOs, and more.

With its versatility and first-mover advantage in the smart contract space, Ethereum continues to be among the best cryptocurrencies to invest in.

Solana (SOL): High-Speed Blockchain

Solana has gained attention for its lightning-fast transaction speeds and low fees.

Why Solana Is Worth Watching

-

Scalability: Can process over 65,000 transactions per second.

-

Growing ecosystem: Hosts a range of DeFi projects, NFT marketplaces, and Web3 apps.

-

Active development: Regular updates and new project integrations.

-

Lower costs: Ideal for retail users and smaller transactions.

Though it has faced some technical setbacks, Solana’s performance and community growth still earn it a spot among the best cryptocurrencies to invest in this year.

Chainlink (LINK): Bridging Real-World Data and Blockchain

Chainlink is a decentralized oracle network that brings real-world data to smart contracts.

Chainlink’s Value Proposition

-

Essential for DeFi: Enables accurate price feeds and event data for DeFi applications.

-

Partnerships: Collaborates with Google Cloud, SWIFT, and major blockchains.

-

Security and reliability: Operates across multiple chains and feeds.

-

Growing use cases: Insurance, gaming, weather forecasting, and more.

Given its essential role in blockchain infrastructure, Chainlink remains one of the best cryptocurrencies to invest in for investors interested in the foundational layer of the crypto ecosystem.

Polkadot (DOT): Interoperability Innovator

Polkadot aims to connect various blockchains, making them interoperable and scalable.

Key Advantages

-

Parachains: Independent blockchains that can run simultaneously on the network.

-

Cross-chain communication: Bridges between Ethereum, Bitcoin, and other networks.

-

Strong backing: Founded by Ethereum co-founder Gavin Wood.

-

Community governance: Token holders help shape the future of the protocol.

For those who believe in a multi-chain future, Polkadot is one of the best cryptocurrencies to invest in for long-term infrastructure potential.

Cardano (ADA): Research-Driven Blockchain

Cardano stands out for its academic approach and layered architecture.

Highlights of Cardano

-

Peer-reviewed development: Every upgrade is based on academic research.

-

Environmental sustainability: Uses PoS, making it energy-efficient.

-

Smart contracts: Recently introduced through the Alonzo upgrade.

-

Global reach: Focuses on real-world applications, especially in developing countries.

While slower to develop than some competitors, Cardano’s thoughtful evolution and loyal community make it a contender among the best cryptocurrencies to invest in.

Avalanche (AVAX): Scalable and Secure

Avalanche offers high performance and supports both Ethereum-compatible and native smart contracts.

What Makes Avalanche Unique

-

High throughput: Capable of handling thousands of transactions per second.

-

Subnets: Customizable blockchains for specific use cases.

-

Low latency: Near-instant transaction finality.

-

Ecosystem growth: DeFi, NFTs, and enterprise applications.

Avalanche’s emphasis on performance and customization makes it one of the best cryptocurrencies to invest in for those seeking scalable platforms.

Ripple (XRP): Transforming Cross-Border Payments

Ripple aims to revolutionize the global payment system.

Why XRP Still Matters

-

Bank adoption: Used by financial institutions worldwide for fast, low-cost transfers.

-

Strong team and backing: Ripple Labs continues to push for legal clarity.

-

Legal battles: Victory in the SEC case could unlock massive potential.

-

Speed and cost: Settles transactions in seconds with minimal fees.

Despite regulatory hurdles, XRP’s utility in the financial sector keeps it on the list of the best cryptocurrencies to invest in.

Toncoin (TON): Telegram’s Blockchain Ambition

Originally developed by Telegram, the TON blockchain is now community-driven and growing rapidly.

Toncoin’s Appeal

-

Messaging integration: Potential for crypto integration directly in messaging apps.

-

High scalability: Shard-based architecture.

-

Decentralization: Transitioned to community governance.

-

User-friendly: Designed for ease of use and mass adoption.

With a strong brand association and ambitious roadmap, Toncoin is an emerging project among the best cryptocurrencies to invest in for the next generation of users.

Emerging Projects to Watch

Beyond the heavyweights, several smaller projects show promise and could offer high returns:

-

Arbitrum (ARB): Leading Layer-2 scaling solution for Ethereum.

-

Optimism (OP): Another Layer-2 solution focusing on rollup technology.

-

Render (RNDR): Decentralized GPU rendering power.

-

Starknet (STRK): Zero-knowledge rollup for fast, private transactions.

-

Celestia (TIA): Data availability layer separating consensus from execution.

These may not yet be household names, but they could prove to be some of the best cryptocurrencies to invest in for higher-risk, higher-reward portfolios.

Tips for Choosing the Best Cryptocurrencies to Invest In

Investing in crypto is not a one-size-fits-all approach. Here are some practical tips to help you build a strong portfolio:

1. Diversify

Don’t put all your capital into a single coin. A mix of large caps (like BTC and ETH), mid caps (like SOL, DOT), and small caps (emerging tokens) reduces risk.

2. Do Your Own Research (DYOR)

Always verify information through whitepapers, developer updates, and community feedback.

3. Consider Time Horizon

Short-term traders focus on volatility, while long-term holders (HODLers) seek fundamental value growth.

4. Stay Updated

Follow crypto news, regulatory updates, and industry developments. Things change quickly.

5. Use Secure Wallets

Never leave large amounts of crypto on exchanges. Use cold wallets or hardware wallets for long-term storage.

Common Pitfalls to Avoid

-

FOMO investing: Don’t invest just because a coin is trending.

-

Ignoring fundamentals: Meme coins may be fun but often lack long-term value.

-

Scams and rug pulls: Be wary of projects with anonymous teams or unrealistic promises.

-

Overtrading: Excessive buying and selling can lead to losses due to fees and bad timing.

Conclusion: Navigating the Crypto Landscape in 2025

Cryptocurrency investment offers incredible potential but also comes with risks. The best cryptocurrencies to invest in are those with real-world use cases, active development, and strong communities. While Bitcoin and Ethereum remain foundational, projects like Solana, Chainlink, Polkadot, and newer players like Toncoin also offer compelling opportunities.

As with any investment, it’s crucial to align your crypto portfolio with your financial goals, risk tolerance, and time horizon. Stay informed, be patient, and always invest wisely.

How to Analyze a Cryptocurrency Before Investing

Before you decide to allocate capital, understanding how to analyze a cryptocurrency is essential. There’s more to it than price trends and social media hype. Here are the key areas of due diligence:

1. Whitepaper Review

A crypto project’s whitepaper outlines the vision, use case, technology, tokenomics, and roadmap. Reading the whitepaper allows you to assess:

-

The problem it solves

-

How the token works in the ecosystem

-

Distribution model (fair launch, pre-mined, ICO, etc.)

-

Plans for future development

Projects with vague or overly complex whitepapers should raise red flags.

2. Team and Advisors

Investigate who is behind the project:

-

Do they have experience in blockchain, software, or finance?

-

Have they delivered successful projects before?

-

Are they publicly doxxed and transparent?

A project backed by a strong, reputable team is more likely to succeed in the long run.

3. Tokenomics

Tokenomics refers to the economic structure of a cryptocurrency. Ask:

-

What’s the total supply?

-

Is the token inflationary or deflationary?

-

Are there mechanisms for burning or staking?

-

Who owns the largest wallets?

Unbalanced tokenomics can lead to pump-and-dump schemes or unsustainable growth.

4. Community and Ecosystem

The strength of a crypto community can significantly influence its success. Check for:

-

Active Twitter/X, Discord, and Telegram groups

-

Transparent developer communication

-

Third-party integrations and dApps being built on the platform

A vibrant ecosystem around the coin signals real utility and potential longevity.

Crypto Investment Strategies for 2025

There’s no single best strategy, but depending on your risk tolerance and goals, these are some common approaches to investing in the best cryptocurrencies to invest in:

HODLing

The simplest strategy: buy and hold over a long period (usually 2–5 years). Best suited for coins like Bitcoin, Ethereum, and Cardano.

-

Pros: Less stress, no need to time the market.

-

Cons: Vulnerable to long bear markets.

Dollar-Cost Averaging (DCA)

Invest a fixed amount regularly (e.g., weekly or monthly), regardless of market price. This strategy helps reduce the impact of volatility.

-

Ideal for beginners

-

Works best with strong assets like BTC and ETH

Swing Trading

Involves buying low and selling high over days or weeks. You’ll need technical analysis skills and market awareness.

-

Pros: Can generate quick returns.

-

Cons: Riskier and time-consuming.

Yield Farming and Staking

Earn passive income by locking up your tokens to support the network or DeFi platforms.

-

Staking coins: ETH, ADA, SOL, AVAX

-

DeFi protocols: Aave, Curve, Yearn Finance

This strategy helps you grow your portfolio while holding the best cryptocurrencies to invest in.

Regulatory Landscape in 2025

Cryptocurrency regulation remains one of the biggest influences on investor sentiment.

United States

-

The SEC is actively clarifying the status of cryptocurrencies.

-

Bitcoin and Ethereum are likely considered commodities, while many altcoins face scrutiny as potential securities.

Europe

-

The EU’s MiCA (Markets in Crypto-Assets) regulation provides a comprehensive framework, focusing on consumer protection and stablecoins.

Asia

-

Japan and South Korea have embraced regulation and innovation.

-

China has banned most crypto trading but supports blockchain technology.

-

Southeast Asia (especially Singapore and Vietnam) is emerging as a crypto hub.

Understanding regulation is critical before investing in the best cryptocurrencies to invest in, especially if you’re looking at altcoins or DeFi tokens.

DeFi, NFTs, and the Future of Blockchain Use Cases

While much of the focus remains on coins, the future of blockchain lies in its use cases:

DeFi (Decentralized Finance)

By eliminating intermediaries, DeFi enables lending, borrowing, and trading in a peer-to-peer manner.

-

Top platforms: Aave, Uniswap, Compound, MakerDAO

-

Opportunities: High-yield farming, governance voting, protocol revenue sharing

Some of the best cryptocurrencies to invest in are directly tied to DeFi, like UNI, AAVE, or CRV.

NFTs (Non-Fungible Tokens)

NFTs are unique digital assets representing ownership of content—art, music, virtual real estate.

-

Popular blockchains: Ethereum, Solana, Polygon

-

NFT coins: Rarible (RARI), Decentraland (MANA), The Sandbox (SAND)

Gaming and the Metaverse

Blockchain-based gaming is booming, with projects integrating NFTs, virtual economies, and decentralized identities.

-

Coins to watch: Immutable (IMX), Gala (GALA), Axie Infinity (AXS), Render (RNDR)

This layer adds diversity to the best cryptocurrencies to invest in depending on sector-specific growth.

Risk Management When Investing in Crypto

Crypto offers huge upside—but also huge risk. Here’s how to manage it:

Set Realistic Goals

Are you investing to make a quick profit, or to build long-term wealth? Let your goals shape your portfolio and behavior.

Use Stop-Losses

For trading accounts, using stop-loss orders can limit downside risk in volatile conditions.

Don’t Overleverage

Many platforms offer margin trading or perpetual futures. Leverage can multiply gains—but also your losses.

Secure Your Assets

Use two-factor authentication, hardware wallets, and avoid phishing scams. Losing your private key means losing your funds—forever.

The Role of Stablecoins in a Crypto Portfolio

Stablecoins like USDT, USDC, and DAI play a strategic role:

-

Liquidity: Easy to exit volatile positions without moving to fiat.

-

DeFi collateral: Can be staked or lent for passive income.

-

Risk-off assets: Act as a safe haven during market downturns.

While not investment assets themselves, stablecoins are essential tools when navigating the best cryptocurrencies to invest in.

Final Thoughts: Building a Balanced Crypto Portfolio

As 2025 unfolds, the crypto market continues to mature. The best cryptocurrencies to invest in may shift slightly with each new trend, but solid fundamentals remain the key to long-term success.

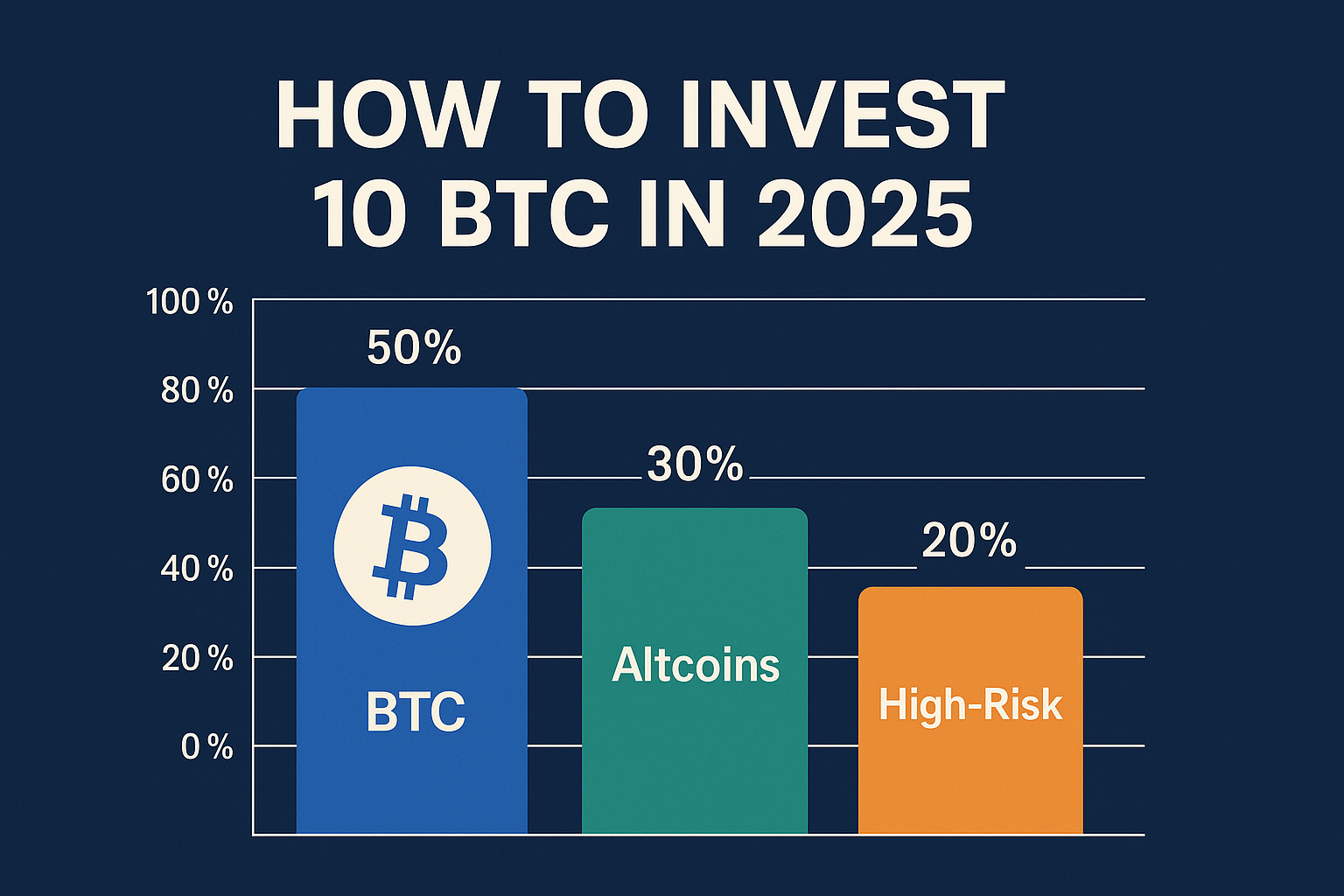

Here’s how you might structure a diversified portfolio:

-

40% in blue-chip cryptos: Bitcoin, Ethereum

-

30% in smart contract platforms: Solana, Avalanche, Cardano

-

15% in infrastructure and oracles: Chainlink, Polkadot, Arbitrum

-

10% in emerging sectors: Gaming, AI, ZK-rollups

-

5% in stablecoins: For liquidity and passive income strategies

Key Takeaways

-

There is no single “best” coin for everyone. It depends on your risk tolerance, strategy, and timeline.

-

Bitcoin and Ethereum remain foundational, but newer projects offer growth opportunities.

-

Do your research. Avoid hype. Focus on fundamentals.

-

Use secure platforms and wallets. Protect your keys.

-

Stay informed about regulations, trends, and technological developments.

In 2025, the opportunity is not just to profit—but to be part of a paradigm shift in how we understand value, ownership, and finance.

Future Trends Shaping the Best Cryptocurrencies to Invest In

To make smart investment decisions, it’s important not only to look at the current best cryptocurrencies to invest in but also to consider future trends that could redefine the entire market.

1. Artificial Intelligence (AI) + Blockchain

Projects that integrate AI with blockchain—such as Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN)—are gaining traction. AI can improve data analysis, trading algorithms, and predictive modeling within DeFi and logistics sectors.

2. Real World Asset (RWA) Tokenization

One of the most exciting narratives of 2025 is the tokenization of real-world assets, such as real estate, stocks, and commodities. Ethereum, Avalanche, and Polkadot are likely to benefit as platforms that support compliant tokenization infrastructure.

3. CBDCs and Regulatory Integration

Central Bank Digital Currencies (CBDCs) will coexist with decentralized currencies. Investors should watch how regulation integrates with open crypto networks. Coins that help bridge compliance, like Chainlink or Ripple, may see explosive growth.

Your Next Steps as a Crypto Investor

Ready to dive in? Here’s a step-by-step action plan:

-

Choose your platform: Binance, Coinbase, Kraken, or decentralized options like Uniswap.

-

Set up a secure wallet: MetaMask for daily use; Ledger or Trezor for long-term storage.

-

Pick your coins: Use this guide as a starting point and focus on 4–6 high-conviction assets.

-

Track your investments: Use apps like CoinStats, Delta, or even Excel.

-

Stay educated: Follow trusted sources like CoinDesk, The Block, and key YouTubers/analysts.

The best time to start investing in crypto was yesterday. The second-best time is today—armed with knowledge, strategy, and awareness.

In summary, the best cryptocurrencies to invest in are those that combine strong fundamentals, real-world utility, active development, and robust community support. While trends may shift, your success will depend on how well you research, diversify, and manage your crypto portfolio.

Now it’s your move. Will you be a spectator in the new digital economy—or an investor?