Best cryptocurrency to invest in today for short-term the world of cryptocurrency offers immense opportunities, not only for long-term wealth but also for fast gains within shorter periods. For traders and investors looking to capitalize on short-term price swings, volatility can be a powerful ally—if approached with the right knowledge and risk management. In this article, we break down the best cryptocurrency to invest in today for short-term, along with proven strategies, risk factors, and tools to maximize returns in 2025.

Why Focus on Short-Term Crypto Investments?

Short-term trading in crypto typically involves holding an asset for anywhere from a few minutes to several weeks. Here’s why it appeals to many:

-

High Volatility = High Potential: Crypto is known for rapid price movements, creating daily opportunities.

-

24/7 Market: Unlike traditional stocks, crypto never sleeps, allowing trades at any time.

-

Multiple Strategies: From day trading to swing trading, the crypto space supports a wide range of short-term tactics.

-

Faster ROI: Unlike long-term investing that may take years, short-term trades can bring profits within hours or days.

However, the same volatility that creates profit potential also introduces risk. That’s why selecting the best cryptocurrency to invest in today for short-term requires analysis, discipline, and planning.

What Makes a Crypto Suitable for Short-Term Investment?

When identifying the top short-term crypto assets, here are the most important characteristics to consider:

-

High Liquidity: Easy to enter and exit trades without large price impact.

-

Strong Trading Volume: Indicates active interest from the market.

-

Volatility: Sharp price movements create potential profit zones.

-

News Sensitivity: Reacts quickly to updates, partnerships, or market events.

-

Technical Analysis Friendly: Clear patterns that align with common chart setups.

Now let’s explore the top candidates for the best cryptocurrency to invest in today for short-term profits.

Top 10 Best Cryptocurrency to Invest in Today for Short-Term

1. Solana (SOL)

Why It’s Great for Short-Term:

-

Highly volatile with frequent price swings

-

Strong social media following fuels momentum trading

-

Benefits from NFT and DeFi growth on its network

Short-Term Strategy Tip: Use RSI and Bollinger Bands to identify breakout moments during high volume periods.

2. Dogecoin (DOGE)

Why It’s Great for Short-Term:

-

Meme-driven price action often leads to explosive runs

-

Elon Musk and X.com integration rumors increase volatility

-

Low entry price invites retail traders

Short-Term Strategy Tip: Watch Twitter trends and Reddit communities for sudden surges in hype.

3. Toncoin (TON)

Why It’s Great for Short-Term:

-

Integrated with Telegram, opening access to hundreds of millions of users

-

Frequently makes headlines in Web3 and social media discussions

-

High daily volume and short-term news catalysts

Short-Term Strategy Tip: Follow major TON app launches and Telegram updates for rapid price movement opportunities.

4. Pepe (PEPE)

Why It’s Great for Short-Term:

-

Highly speculative meme coin with extreme pump potential

-

Notable for dramatic intra-day swings

-

Attracts large retail trading volume during meme coin rallies

Short-Term Strategy Tip: Trade only with stop-losses, and enter during breakout setups with volume confirmation.

5. Render (RNDR)

Why It’s Great for Short-Term:

-

Tied to AI and GPU rendering narratives

-

Frequently reacts to AI-related headlines

-

Clear technical structures for swing trading

Short-Term Strategy Tip: Use moving averages crossovers to catch momentum-based entries and exits.

6. Polygon (MATIC)

Why It’s Great for Short-Term:

-

High liquidity and listed on nearly all exchanges

-

Reacts positively to partnership announcements

-

Attractive price zones for swing trades

Short-Term Strategy Tip: Look for consolidation patterns before breakout runs tied to Ethereum ecosystem updates.

7. Arbitrum (ARB)

Why It’s Great for Short-Term:

-

As a leading Layer 2 scaling solution, it reacts to Ethereum news

-

Regular airdrop rumors and development updates

-

High trading volume supports day trading strategies

Short-Term Strategy Tip: Use Fibonacci retracement during retracement phases to identify re-entry levels.

8. Sui (SUI)

Why It’s Great for Short-Term:

-

New Layer 1 blockchain with rapid ecosystem growth

-

Reacts quickly to funding or project launches

-

Speculative interest drives sudden price swings

Short-Term Strategy Tip: Trade during project listing events or mainnet upgrades.

9. Injective Protocol (INJ)

Why It’s Great for Short-Term:

-

Low-cap altcoin with frequent momentum spikes

-

Part of decentralized derivatives narrative

-

Reacts to both DeFi and institutional trading news

Short-Term Strategy Tip: Monitor breakout from cup-and-handle or triangle patterns.

10. Bitcoin (BTC)

Why It’s Great for Short-Term:

-

Most liquid asset in crypto

-

Moves set the tone for the entire market

-

Works well for leveraged trading with clear technical signals

Short-Term Strategy Tip: Use BTC dominance chart to assess whether BTC is outperforming altcoins before trading.

Short-Term Trading Strategies That Work in Crypto

Choosing the best cryptocurrency to invest in today for short-term is just the first step. Applying the right strategy is what drives real returns.

1. Scalping

-

Fast-paced trades (minutes to hours)

-

Focus on small price changes

-

Requires tight stop-losses and quick execution

2. Swing Trading

-

Hold for days to weeks

-

Use technical analysis to enter at pullbacks or breakouts

-

Ideal for traders with less time than scalpers

3. Momentum Trading

-

Ride the trend during strong directional moves

-

Follow volume, social media buzz, or market catalysts

4. News-Based Trading

-

Buy on news and rumors, sell on the event

-

Ideal for coins like DOGE or PEPE with social media sensitivity

Risk Management for Short-Term Crypto Investors

Short-term trading without risk control is gambling. Protect your capital with:

-

Stop-Loss Orders: Predetermine your loss limit per trade.

-

Risk/Reward Ratio: Aim for 1:2 or higher (risking $1 to gain $2).

-

Position Sizing: Don’t go all-in; allocate a portion per trade.

-

Limit Emotional Trading: FOMO and panic selling destroy profits.

Even the best cryptocurrency to invest in today for short-term can result in losses without discipline.

Tools for Short-Term Crypto Traders

To succeed in the fast-paced crypto market, use the following platforms:

Charting Tools

-

TradingView: Best for technical analysis

-

CoinGlass: Monitor funding rates, open interest

-

CryptoQuant: On-chain data for trade signals

News and Sentiment

-

Twitter/X: Track influencers and project updates

-

CoinTelegraph / Decrypt: Fast news coverage

-

LunarCrush: Sentiment analytics

Portfolio Management

-

Delta or CoinStats: Track short-term entries and exits

-

Zerion: DeFi asset management

-

Pionex: Automated bots for grid trading

Common Mistakes in Short-Term Crypto Trading

Avoid these pitfalls when selecting your best cryptocurrency to invest in today for short-term:

-

Overtrading: Taking too many positions leads to poor judgment.

-

No Clear Strategy: Don’t trade on gut feeling.

-

Ignoring the Trend: Trend is your friend—don’t fight it.

-

Skipping Risk Management: One bad trade can wipe out weeks of profit.

-

Overusing Leverage: Amplifies both gains and losses. Use cautiously.

Timing the Market: When to Enter Short-Term Trades

Timing is everything in short-term crypto trading:

-

High-Volume Hours: Best time is during U.S. or Asia market overlap.

-

Right After News Drops: Enter trades minutes after key announcements.

-

Breakout Patterns: Use technical setups like flags, triangles, or double bottoms.

-

Before Major Token Events: Look for mainnet launches, listings, or burn announcements.

The best cryptocurrency to invest in today for short-term is often the one that just made headlines or broke a key technical level.

Real-World Short-Term Trading Example

Let’s walk through a real-world scenario to show how someone might choose the best cryptocurrency to invest in today for short-term, and how they would trade it.

Scenario: Solana (SOL) Short-Term Trade

-

Date: July 10, 2025

-

Price: $165

-

News Catalyst: Announcement of new Solana-based GameFi partnership with a major publisher

-

Technical Signal: Breakout above recent resistance at $160 with high volume

-

Trade Setup:

-

Entry: $165

-

Stop-loss: $157 (below breakout point)

-

Target 1: $180

-

Target 2: $190

-

Risk/Reward: ~1:2 or 1:3 depending on scale-out plan

-

Outcome: Solana hits $180 within 24 hours and pulls back slightly—trader exits with 9% profit.

Takeaway: The key was the combination of technical setup + news trigger + volume confirmation, a classic approach when identifying the best cryptocurrency to invest in today for short-term.

Sample Technical Analysis on Toncoin (TON)

Toncoin has recently gained attention thanks to Telegram integration. Here’s a quick example of how traders can analyze its price for short-term entries.

-

Chart Pattern: Bullish flag forming on the 4H chart

-

RSI: Neutral at 53, indicating room to move up

-

MACD: Bullish crossover

-

Support Level: $7.80

-

Resistance Level: $8.20

Trade Plan

-

Entry: Upon breakout above $8.20

-

Stop: $7.75

-

Take Profit: $8.80 and $9.10

-

Strategy: Breakout confirmation with trailing stop-loss to lock in profits

Psychology Tips: How to Think Like a Pro Trader

Even when you find the best cryptocurrency to invest in today for short-term, your mindset can determine success or failure. Here are some psychological tips to maintain discipline:

1. Detach From the Outcome

Focus on executing your strategy, not the result of a single trade. Success comes over dozens of trades, not one.

2. Avoid Revenge Trading

Don’t try to “win it back” after a loss. Take a break, analyze your mistake, and move on.

3. Take Partial Profits

Taking 50% profit at a target level while letting the rest ride is a great way to reduce risk.

4. Journal Every Trade

Track:

-

Entry and exit price

-

Setup used

-

Emotion before/after the trade

-

What you learned

Reviewing your journal weekly will make you significantly better.

Top Catalysts That Move Prices Short-Term

To find the best cryptocurrency to invest in today for short-term, monitor these events:

-

Mainnet launches

-

Partnership announcements

-

Token burns or supply cuts

-

Exchange listings (especially Binance, Coinbase)

-

Influencer tweets (Elon Musk, CZ, Vitalik Buterin)

-

Airdrop rumors

-

Protocol upgrades (e.g., Ethereum hard fork)

Websites like CryptoPanic, CoinMarketCal, and Twitter/X are great for staying informed.

Short-Term Market Forecast: What to Expect in 2025

Crypto markets in 2025 are far more mature than during earlier cycles, but volatility remains a trader’s best friend.

Trends to Watch in the Short Term (Q3–Q4 2025)

-

AI Token Surge: As artificial intelligence continues to grow, tokens like RNDR, FET, and AGIX could spike again.

-

Meme Coin Rotation: Expect new meme coins to trend every few weeks—great for ultra-short scalping.

-

Layer 2 Expansion: Coins like ARB, OP, and ZKSync tokens may experience short rallies after new integrations.

-

Telegram/TON Ecosystem Growth: Watch for mini-bull runs inside the TON ecosystem after every DApp launch.

Macro Environment

-

If the U.S. Fed eases interest rates → risk assets (including crypto) could surge.

-

Bitcoin ETF inflows continue → capital spreads to altcoins shortly after.

-

Regulatory clarity in Asia and Europe → boosts confidence for active short-term trading.

Final Summary: Short-Term Crypto Profits in 2025

To wrap up, here’s a recap of how to consistently identify the best cryptocurrency to invest in today for short-term:

✅ Choose coins with high volume, strong volatility, and news catalysts

✅ Use technical patterns like breakouts, flags, RSI divergence

✅ Monitor social sentiment and macroeconomic triggers

✅ Apply stop-losses, take profits, and protect your capital

✅ Log your trades, review performance, and stay emotionally grounded

Bonus Tip: Create a Short-Term Crypto Watchlist

Here’s a suggested watchlist template to update every week:

| Coin | Current Price | Key Catalyst | Support | Resistance | Bias |

|---|---|---|---|---|---|

| SOL | $165 | GameFi launch | $155 | $180 | Bullish |

| DOGE | $0.12 | Elon tweet | $0.10 | $0.15 | Volatile |

| TON | $8.05 | Telegram DApp | $7.80 | $8.80 | Breakout |

| PEPE | $0.0000011 | Meme cycle | N/A | $0.0000014 | Speculative |

| RNDR | $9.20 | Nvidia conference | $8.90 | $10.50 | Bullish |

Update this weekly based on trends, volume, and your chosen strategy.

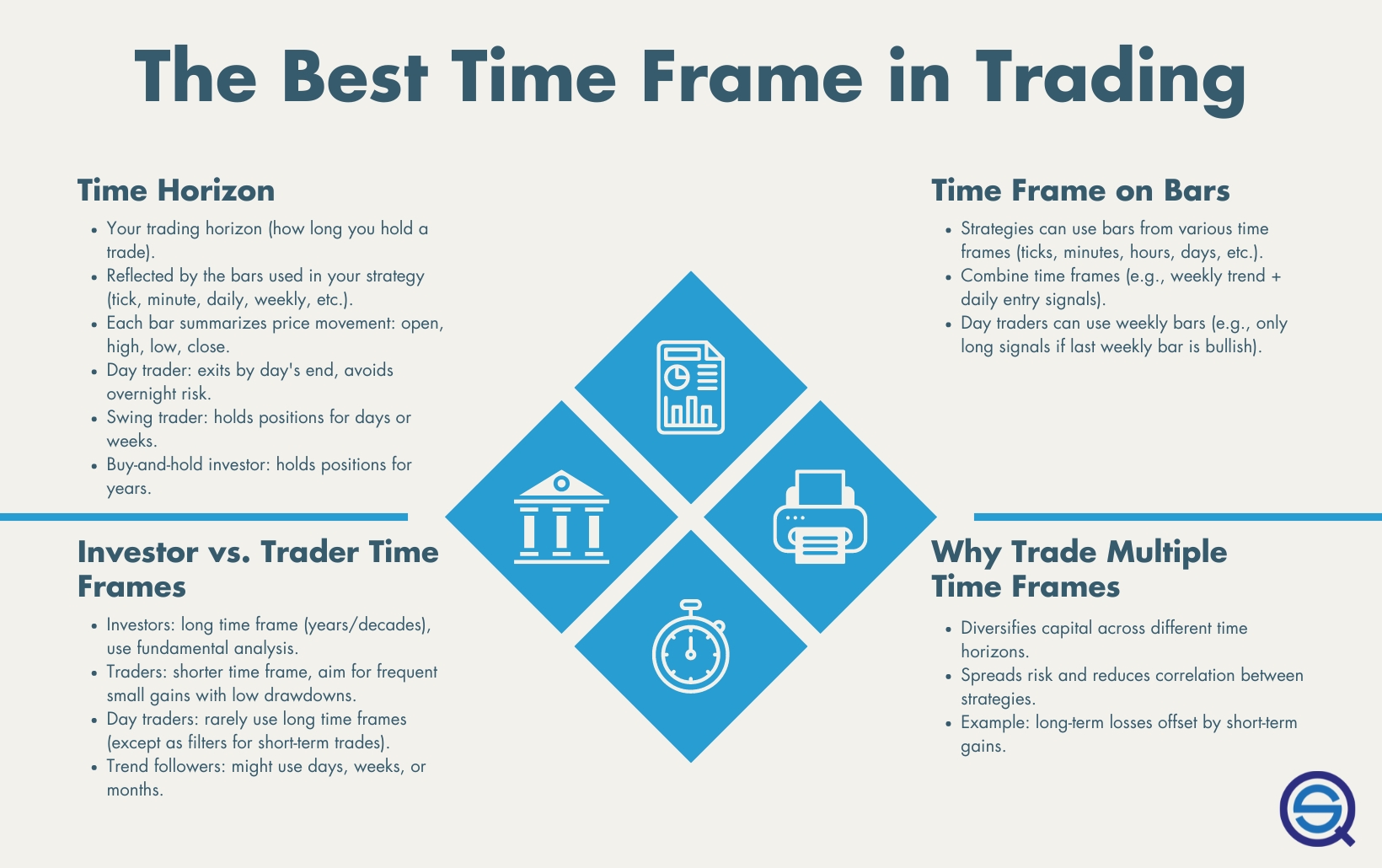

Choosing Your Timeframe: Intraday vs. Swing vs. Weekly

When identifying the best cryptocurrency to invest in today for short-term, define what “short-term” means for you. Each timeframe requires a different mindset and strategy.

Intraday Trading (minutes to hours)

-

Best for highly liquid coins like BTC, ETH, SOL

-

You monitor price charts in real-time and trade within the same day

-

Requires quick decision-making, low latency tools, and discipline

Swing Trading (2–10 days)

-

Commonly used by part-time traders

-

You enter based on a trend setup and ride a movement over a few days

-

Best suited for coins reacting to news or technical setups

Weekly Positioning (5–15 days)

-

Ideal for traders who combine fundamentals with trend-following

-

Typically used with medium-cap coins or ecosystem growth catalysts

-

Coins like TON, RNDR, and ARB often offer week-long rallies

Key Tip: Before you ask, “What’s the best cryptocurrency to invest in today for short-term?”, ask yourself: “What is my timeframe and risk appetite?”

Crypto Event Calendar: What to Watch This Month (July 2025)

Crypto prices often spike before or during key events. Here are some upcoming catalysts that may influence short-term prices:

| Date | Coin | Event | Potential Impact |

|---|---|---|---|

| July 12 | ARB | Major DeFi project launch | High volume, price breakout possible |

| July 15 | SOL | GameFi platform upgrade | Bullish momentum for Solana ecosystem |

| July 18 | TON | Telegram AI integration rollout | Expect hype-driven short-term rally |

| July 20 | DOGE | Elon Musk keynote at AI Summit | Speculative pump likely |

| July 25 | RNDR | GPU marketplace expansion news | AI narrative boost |

Monitor these dates and prepare entry/exit levels ahead of time.

Most Common Mistakes in Short-Term Crypto Investing

Even if you choose the best cryptocurrency to invest in today for short-term, poor habits can wipe out your portfolio. Let’s look at common missteps:

1. Entering Too Late

-

Joining after the hype spike = buying the top

-

Use volume indicators and breakouts for early signals

2. Ignoring the Broader Market Trend

-

Altcoins usually follow Bitcoin. If BTC is falling sharply, avoid aggressive altcoin trades

3. Overusing Leverage

-

Leverage can magnify losses quickly

-

New traders should trade spot or start with 2x maximum leverage

4. FOMO & Panic Selling

-

Emotional decisions lead to poor execution

-

Set your plan and stick to it—don’t let noise distract you

5. No Trade Journal

-

Without tracking your trades, you can’t improve

-

Write down the why/how/result for each trade you take

How to Think Independently in a Hype-Driven Market

Social media moves crypto prices—but not always in the right direction. Here’s how to protect yourself from “groupthink”:

1. Double-Check the Narrative

Before investing in a hyped token:

-

Read the whitepaper (is there a real product?)

-

Search the team (is it doxxed or anonymous?)

-

Analyze tokenomics (is it inflationary?)

2. Don’t Follow Influencers Blindly

-

Many influencers are paid to promote coins

-

Follow those who share analysis, not just buy signals

3. Avoid “Shiny Object Syndrome”

-

Jumping to a new coin every day = shallow research

-

Pick a few assets and study them deeply

Profit-Taking and Reinvestment Strategy

Once you’ve made profits from the best cryptocurrency to invest in today for short-term, the next step is capital management.

1. Lock in Gains

-

Don’t wait for the top—set realistic profit targets (5%, 10%, 20%)

-

Use trailing stop-losses to capture upward moves

2. Diversify Profits

-

Move some profit into stablecoins like USDT, USDC

-

Reallocate into other undervalued coins preparing for their move

3. Compound Wisely

-

Use profits to build longer-term positions in solid assets like ETH, MATIC, or AVAX

-

Consider staking, yield farming, or liquidity pools for passive income

Final Checklist: Short-Term Crypto Trading Essentials

✅ Have I defined my timeframe and risk tolerance?

✅ Did I choose assets with strong short-term catalysts?

✅ Do I have a trade plan (entry, stop-loss, profit target)?

✅ Have I accounted for the macro market trend (BTC, Fed news)?

✅ Am I emotionally calm and prepared to execute?

✅ Am I ready to track the result in my journal?

If you can answer “yes” to all the above—you’re ready to trade the best cryptocurrency to invest in today for short-term.

Conclusion: Turning Knowledge into Profits

Short-term crypto investing in 2025 is a high-stakes, high-reward game. But with the right preparation, mindset, and tools, it can also be a very rewarding one.

To maximize your chances of success:

-

Stick to coins with momentum, volume, and volatility

-

Master the basics of technical analysis

-

Use tight risk controls and trade with a plan

-

Avoid the hype—trust your research

-

Always be learning, refining, and evolving your strategy

Remember: The best cryptocurrency to invest in today for short-term isn’t about luck—it’s about information, execution, and timing.